Resources

Playbooks, case studies, and product insights.

Resources for collections, servicing, disputes, and loss-mitigation leaders who want to apply AI safely in regulated environments.

How AI Outbound Calling Agents Work in 2026

A practical guide to how AI outbound calling works, where it fits in lending operations, and how to deploy it.

View

How AI Transforms Borrower Communication in Modern Lending

"How AI-powered voice and messaging agents help consumer lenders automate borrower communication while staying compliant.

View

The Collections Team Transformation: What to Expect After AI Implementation

AI doesn't replace your collections team — it transforms what they spend their time on.

View

The Compliance Trap: Why Building AI In-House Costs More Than You Think

Most lenders exploring AI voice hit the same wall. The technology works. The compliance infrastructure to prove it works to examiners doesn't exist yet—and building it internally takes longer and costs more than anyone budgeted for.

View

How AI is Strengthening Fair Lending Compliance in 2026

How AI is strengthening fair lending compliance—and what lenders need to build to stay ahead of regulators.

View

Voice AI Automation: Complete Guide for Consumer Lenders

Voice AI automation for consumer lenders: how AI voice agents handle collections, disputes, and customer service with compliance controls built in from the start.

View

How AI Automation Transforms Collections Efficiency in 2026

AI collections automation reduces operational costs by 80% while maintaining FDCPA and TCPA compliance through deterministic guardrails, automated workflows, and real-time audit trails for regulated lenders.

View

Meet Marshall: Your AI Compliance & QA Agent.

Eliminate coverage gaps with Marshall. Monitor 100% of calls, texts, and emails for compliance risks and generate exam-ready evidence automatically.

View

15 Essential Questions to Ask AI Lending Vendors About Compliance

15 essential compliance questions to ask AI lending vendors about FDCPA controls, fair lending, data privacy, and audit readiness. CFPB and NCUA guidance included.

View

How AI is Transforming Consumer Loan Servicing (And How to Not Get Left Behind)

Consumer loan servicing faces a crisis of rising costs and turnover. Discover how AI voice agents are automating collections and compliance to solve it.

View

Meet Taylor: AI Collections and Customer Service That Actually Does the Work

Taylor handles inbound and outbound conversations across voice, text, and email – from welcome and verification to payments, extensions, hardship, and collections.

View

Introducing Agent Studio

The only agent builder designed specifically for regulated lending, with pre-built workflows for collections, verification, welcome calls, and inbound servicing ready to deploy.

View

Deploying Compliant AI Voice at Scale in Loan Servicing

How consumer lenders achieve 100% call coverage, lower costs, and exam-ready compliance with AI

View

$12M saved. 10M calls handled monthly. One platform.

Westlake Financial manages $24 billion in assets and needed a platform that could handle enterprise volume, maintain full compliance coverage, and actually improve outcomes. They partnered with Salient and achieved 45% reduction in servicing headcount while handling 10M+ calls monthly.

View

300,000+ calls. Zero compliance gaps. One platform.

ACA manages over $6 billion in assets and needed a platform that could handle enterprise volume, maintain full compliance coverage, and actually improve outcomes. They chose Salient. Here's why it worked.

View

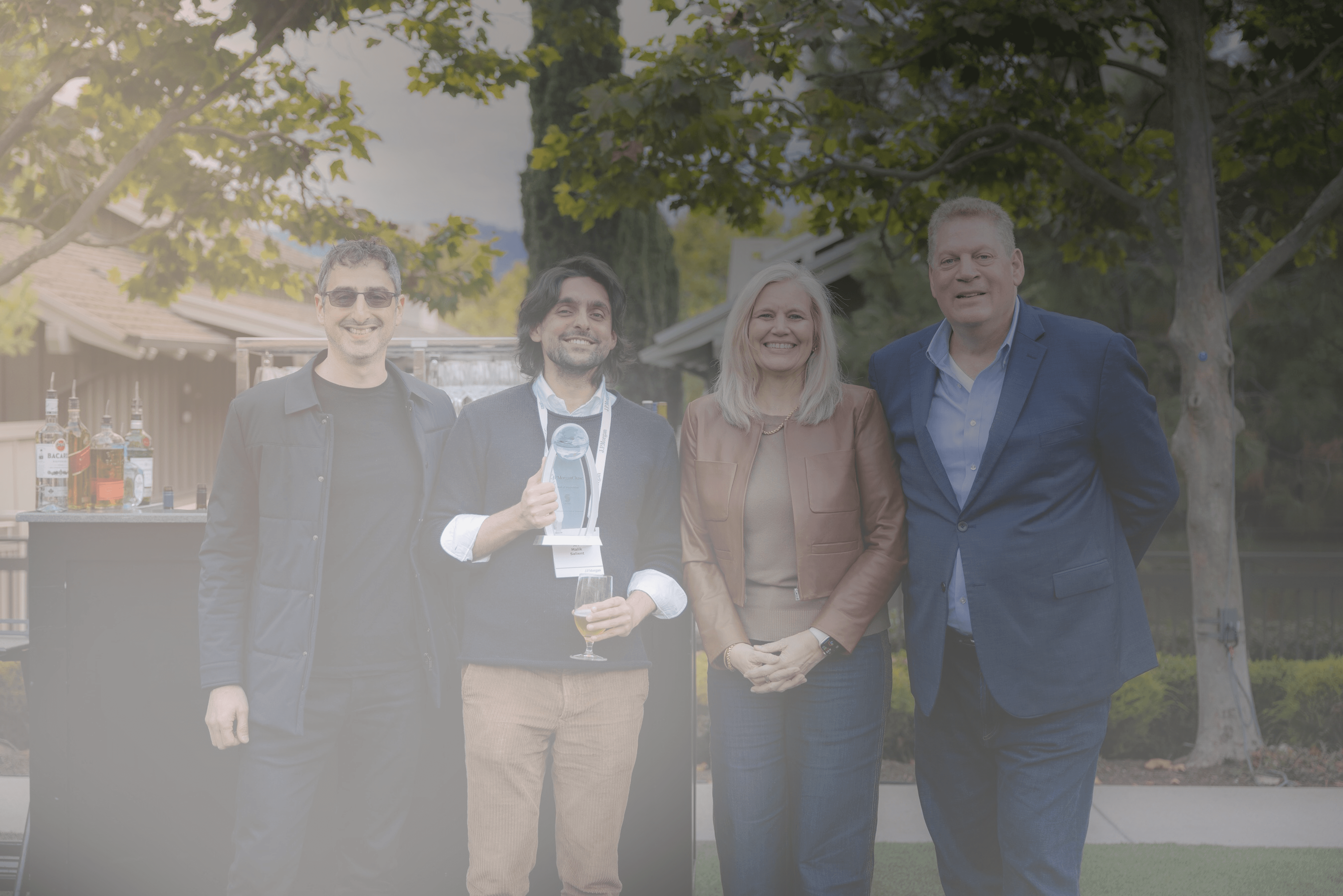

Salient Wins Hall of Innovation Award at JPMorganChase Technology Innovation Symposium

Salient has been inducted into JPMorganChase's Hall of Innovation at the firm's 17th annual Technology Innovation Symposium.

View