Jan 8, 2026

Meet Taylor: AI Collections and Customer Service That Actually Does the Work

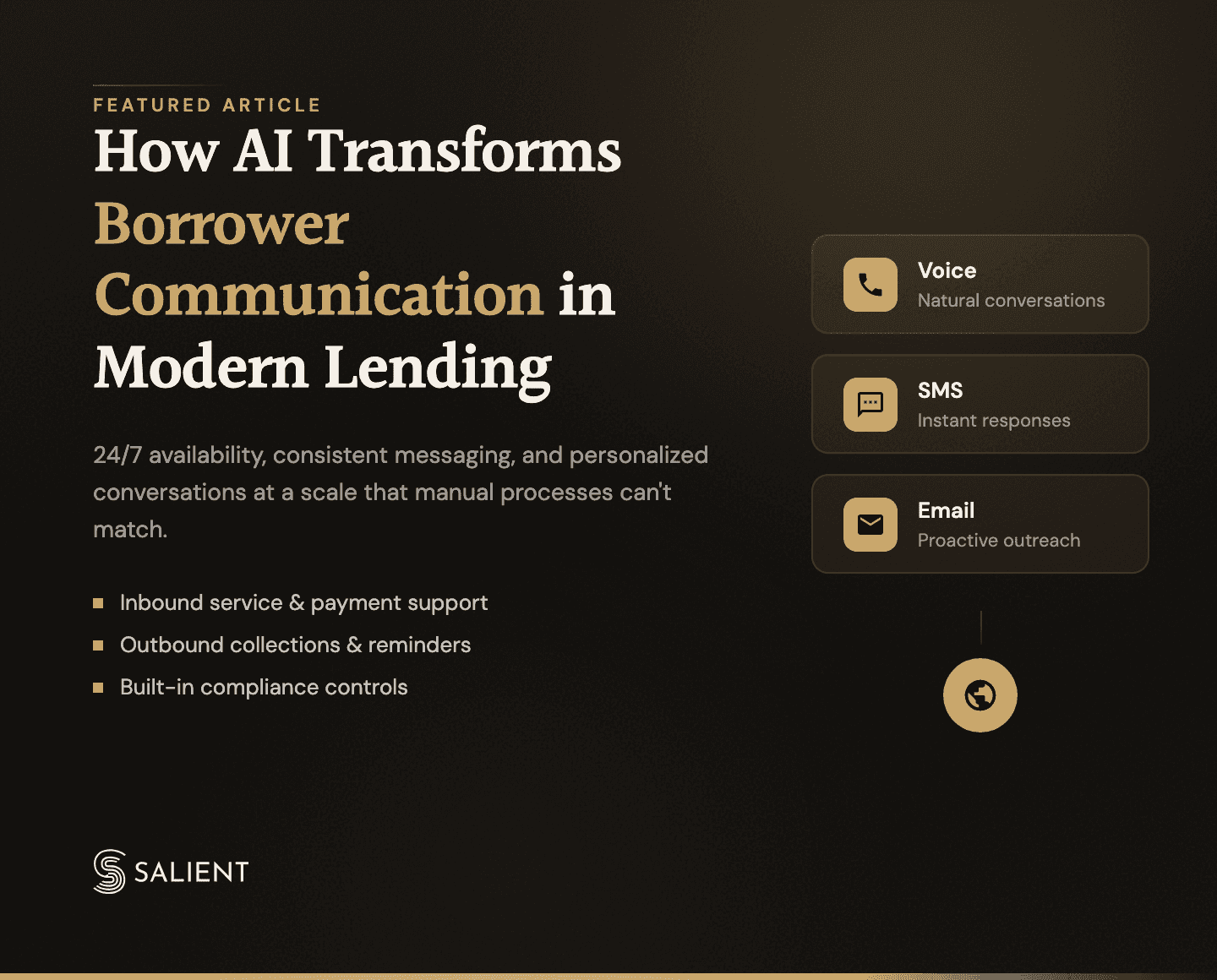

Taylor handles inbound and outbound conversations across voice, text, and email – from welcome and verification to payments, extensions, hardship, and collections.

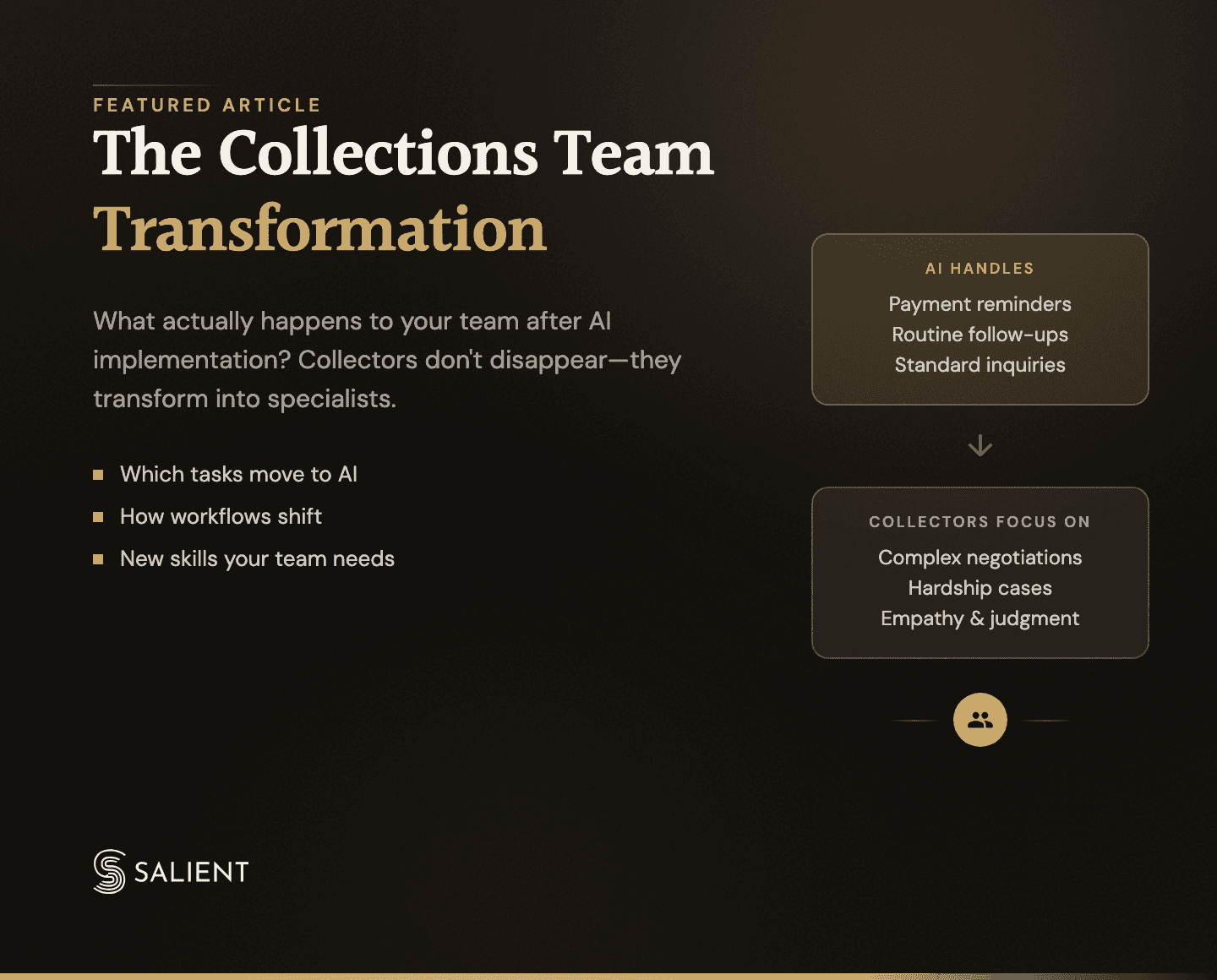

Collections teams handle hundreds of calls per day - payment arrangements, due date changes, hardship discussions, account updates. The volume is constant, and every interaction carries compliance requirements.

Most lenders respond by hiring more agents, extending hours, or accepting lower contact rates. Taylor offers a different approach.

What Taylor Does

Taylor is Salient's AI voice agent for collections and customer service. Taylor handles inbound and outbound conversations across voice, text, and email - from welcome calls and payment support to hardship discussions and collections.

Taylor doesn't just answer questions or route calls. It executes the work:

Accepts payments via phone with secure card and ACH processing Taylor processes payments in real time during calls. Borrowers can pay with a card or set up ACH - Taylor handles verification, processes transactions through your payment stack, and confirms payment before ending the call.

Negotiates extensions within your approved guardrails Taylor understands your extension policies and grants them when borrowers qualify. It explains terms, confirms agreement, and updates accounts immediately.

Updates due dates based on eligibility rules When borrowers need to move payment dates, Taylor checks eligibility, presents available dates, and processes changes in your system. The entire interaction happens in one call.

Routes complex cases to your team with full context Taylor escalates when situations require human judgment. It transfers calls with complete conversation summaries, account details, and borrower requests. Your agents receive full context.

How Taylor Works in Your Environment

Taylor integrates with your existing tech stack - your LMS, contact center platform, and payment processors.

Know the borrower Taylor reads account data, delinquency status, hardship flags, and past interactions from your loan servicing system before and during calls. It accesses what borrowers owe, when they last paid, and what arrangements are in place.

Handle the conversation Taylor answers or places calls through your contact center platform and engages borrowers via SMS and email. All conversations operate within your contact rules, scripts, and compliance requirements.

Take action Taylor executes beyond conversation. It sets payment promises, updates due dates within guardrails, submits payment instructions to payment partners, and routes complex cases to human agents.

Write everything back All notes, promises, outcomes, and status changes write back to your systems in real time. Every interaction feeds into real-time compliance QA, creating an audit trail for every conversation.

Compliance Built In

Taylor operates within your policies and US consumer lending law - FDCPA, UDAAP, and applicable state-specific requirements.

You define what Taylor can say and do. Salient tests those policies against your compliance requirements and configures Taylor's behavior accordingly.

Configuration includes:

Contact windows and frequency caps

Prohibited phrases and escalation triggers

Disclosure requirements

Human transfer triggers

Taylor delivers compliant conversations across the full borrower lifecycle - enforcing your policies and operating within your exact parameters, from first contact through collections.

Real Results

One Salient customer automates 300,000+ calls per month with Taylor, achieving a 55% promise-to-pay rate on collections calls.

This represents actual account resolution - payments processed, extensions granted, due dates updated, and accounts brought current without adding headcount.

Implementation

Taylor deploys across collections operations in weeks. Salient integrates with existing systems, configures Taylor around your policies and scripts, and validates compliance before launch.